Home > Blog > Blog Detail

Over the years, mutual funds have gained transactions amongst investors due to their ease of investment and long-term inflation-beating returns. As an investor, you can choose from a vast range of mutual funds based on your investment goals and risk profile.

One such mutual fund category that investors prefer is large-cap funds. Large-cap funds invest in large-cap companies (i.e. Top 100 companies by Market Capitalisation). They are more stable and consistent with their performance. One factor that comes with these returns is the cost of investing and managing the funds. As a result, the cost associated with investing in large-cap funds (expense ratio) is noticeable.

Read More:

Term Insurance with Return of Premium: Select a new variant to cover life

If you want to avoid this higher expense ratio and still want the benefits of investing in large-cap funds, we have a perfect solution for you –Nifty 50 Index Funds. Index funds are not actively managed. Thus, Investors pay fewer charges and still get excellent returns.

If you are still trying to convince, this article will help you understand how investing in Nifty 50 index funds offers you a comparatively better return. So, let’s get started.

Why Are Index Funds a Better Choice over Large Cap Funds?

Let’s start with the basics. Index funds track an index. The Nifty 50 index invests in the same 50 companies as the index in the same proportion as their market capitalization. Unlike large-cap funds, fund managers do not have to make alterations in the investment funds actively. Their responsibility is limited to replicating the Nifty 50 index. As a result, index funds are also known as passive funds.

However, just so you know, if there are any changes in the index composition, the Nifty 50 fund will also showcase the exact change. The return of Nifty 50 will directly impact the return of the fund.

Here are a few key advantages of investing in Nifty 50 index funds over large-cap funds.

Compared to large-cap funds, Nifty 50 funds have low expense ratios, which means a large chunk of your money goes towards investing in the underlying index instead of covering the cost of investments. For example, UTI Nifty 50 Index Fund has an expense ratio of 0.3%, while SBI Blue Chip Fund has an expense ratio of 1.59%.

This fund is diversified across 50 companies, which helps to spread out risk and provide more consistent returns over time. While large-cap funds do the same, investment funds are allocated based on sector and market capitalization and need active management. This is not the case with Nifty 50 funds. The changes in the Nifty 50 index are not as frequent as changes in the market cap of stocks. Thus, index funds add stability to investment portfolios compared to large-cap funds.

Read More:

Are you planning to save tax? Invest in equity product ELSS

Because the Nifty 50 Index Fund tracks the Nifty 50 Index and aims to replicate the same, it does not require active management. As a result, compared to large cap funds, they are low maintenance and offer benefits of passive investment strategy to investors since constant monitoring is not required.

Nifty 50 Index Funds, or for that matter, any index fund, imposes no exit load on investors. Exit load is the charge that needs to be paid if an investor decides to leave the mutual fund schemes before a specific period. No exit load allows investors to change or exit the scheme if it doesn’t align with their goals. On the other hand, for large-cap funds, exit load is applicable if an investor leaves the fund before a certain period, such as six months or a year.

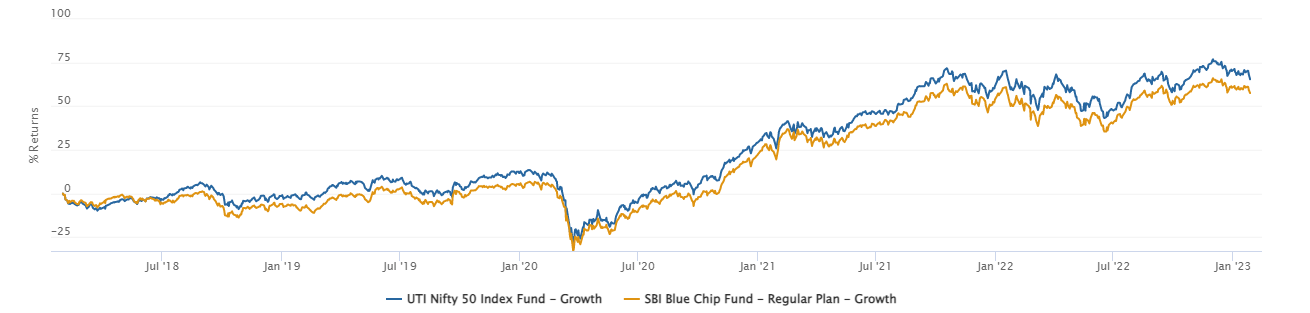

This is the most crucial aspect of investing in Nifty 50 Index Funds. Over the years, the Nifty index has constantly risen. From around 5000+ in 2010 to currently around 17,500+, the index has seen a constant rise, which also reflects in the returns of Nifty 50 index funds. While large-cap stocks and, in turn, large-cap funds have also performed well, compared to the Nifty 50 Index, their returns are almost similar, as seen in the chart below.

As you can see between UTI Fund and SBI Blue Chip, the index fund has given higher returns over five years with good margins and a lower expense ratio.

These five factors provide a clear picture of how the Nifty 50 Index Fund is far better than large-cap funds, with the highlight being better returns and lower costs.

Now comes the critical question of which Nifty 50 Index Fund you should invest in. Well, for that also, we have got you covered. Let’s get into it.

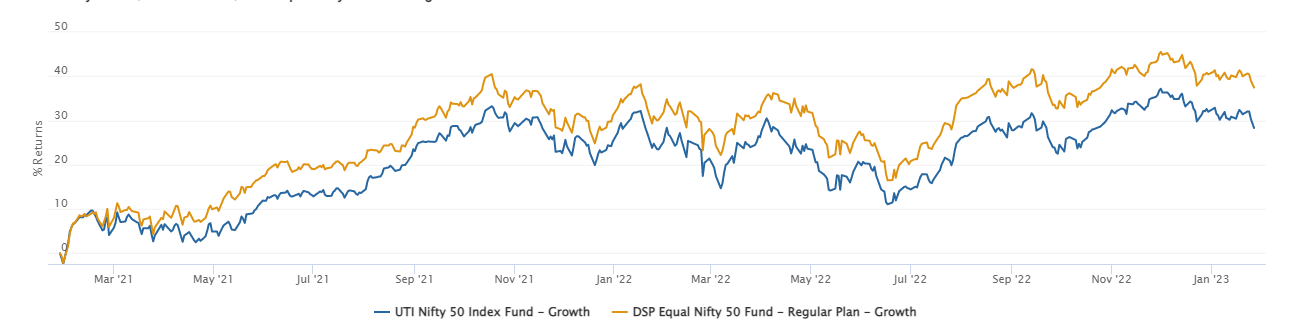

While Nifty 50 Index Funds replicate the exact stock compositions of Nifty 50, the Nifty 50 Equal Weight Index gives the same weightage to all the stocks and allocates similar funds. In other words, at the time of review, The Nifty 50 Equal Weight Index aims to measure the performance of constituents forming part of the Nifty 50 index, where each company in the index shall be assigned equal weights. Which one is better? The below two-year chart will help you.

We have narrowed it down to two funds: i) DSP Nifty 50 Equal Weight Index Fund and ii) UTI Nifty 50 Index Fund. The chart depicts that returns generated by DSP Nifty 50 Equal Weight Index Fund are higher than UTI Nifty 50 Index Funds in the two years. However, long-term returns also matter.

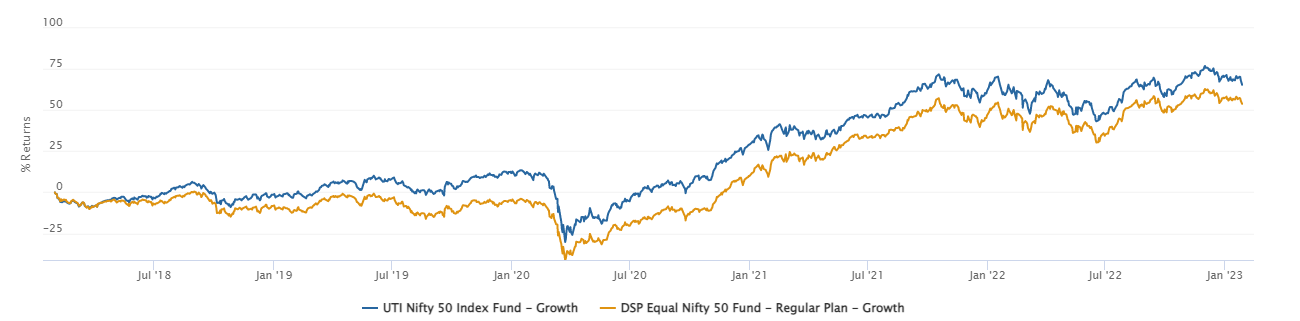

As seen, the tables have turned with UTI Nifty 50 Index Fund beating the returns of its counterpart.

The Nifty 50 Equal Weight Index gives due importance to all 50 stocks. The same is not the case with the regular Nifty 50 Index Fund. The letter provides more significance to stocks based on their market cap composition.

Over the years, large-cap stocks outperform mid and small-cap funds, reflecting higher return yield. See the table below for a comparison between the funds’ returns for the five years.

| Constituents of NIFTY 50 Index | % Holding in Index Fund – A | 5-year CAGR

(IN %) – B |

Difference in % Holding between Nifty Index fund & Equal Weight – C

(A – 2%) |

Excess Returns generated by Index fund (B * C) |

| Reliance Industries Ltd. | 10.97% | 22 | 8.97% | 1.9734 |

| ICICI Bank Ltd. | 7.76% | 20 | 5.76% | 1.152 |

| Infosys Ltd. | 6.89% | 22 | 4.89% | 1.0758 |

| Tata Consultancy Services Ltd. | 4.17% | 18 | 2.17% | 0.3906 |

| Bajaj Finance Ltd. | 2.19% | 29 | 0.19% | 0.0551 |

| Indusind Bank Ltd. | 0.99% | -7 | -1.01% | 0.0707 |

| Oil & Natural Gas Corporation Ltd. | 0.71% | -5 | -1.29% | 0.0645 |

| Coal India Ltd. | 0.59% | -5 | -1.41% | 0.0705 |

| TOTAL | 4.8526% |

UTI Index Fund has invested heavily in large-cap funds and has yielded better returns. However, you should note that investments can go downhill if the same stocks have underperformed.

Index funds offer higher returns, and equal-weighted index funds reduce the risk and concentration risk by adding actual diversification benefits.

You might wonder why we chose the DSP Nifty 50 Equal Weight Index fund. To answer this, we would like to highlight two important factors.

Tracking Error: Tracking error is the standard deviation of the difference between the returns of an investment and its benchmark.

Tracking Difference: Tracking difference is a passive fund’s performance compared with its benchmark over a certain period.

The table shows the interest generated by various equal-weight schemes.

| Scheme | Tracking Error* Regular (%) | Tracking Difference*

Regular 1-Year (%) # |

| Aditya Birla Sun Life Nifty 50 Equal Weight Index Fund | 0.14 | -1.54 |

| DSP Nifty 50 Equal Weight Index Fund | 0.06 | -1.03 |

| HDFC NIFTY50 Equal Weight Index Fund | 0.09 | -1.34 |

| ICICI Prudential Nifty50 Equal Weight Index Fund * | 0.16 | — |

It is evident from the table above that the DSP Nifty 50 Equal Weight Index Fund has the lowest tracking error and tracking difference as well. It tops our list.

We also have a list if you prefer investing in regular index funds over Nifty 50 equal-weight funds.

| Scheme | Tracking Error Regular (%) | Tracking Difference Regular 5-Year (%) # |

|---|---|---|

| UTI Nifty 50 Index Fund | 0.03 | -0.40 |

| IDFC Nifty 50 Index | 0.12 | -0.43 |

| HDFC Index Fund Nifty 50 Plan | 0.04 | -0.59 |

| Tata Nifty 50 Index Fund | 0.11 | -0.80 |

| ICICI Prudential Nifty 50 Index Fund | 0.07 | -0.82 |

| SBI Nifty Index Fund | 0.03 | -0.96 |

We will move ahead with the same two parameters, and based on them, these six funds are good investment choices. The UTI Nifty 50 Index Fund is stealing the show with the lowest tracking error and tracking difference.

Here comes the most exciting part. Let’s compare the funds we discussed for the Nifty 50 Equal Weight, Nifty 50, and Large Cap categories.

| Particulars | DSP Nifty 50 Equal Weight Index | UTI Nifty 50 Index Fund | SBI Blue Chip Fund |

| Returns- | |||

| 6 months | 13.29% | 8.59% | 9.55% |

| 1 year | 2.27% | 3.79% | -1.55% |

| 2 years | 17.21% | 13.28% | 13.24% |

| 3 years | 18.55% | 15.04% | 15.53% |

| 5 years | 10.04% | 11.32% | 10.27% |

| Expense ratio | 0.95% | 0.3% | 1.59% |

| Alpha | -1.59 | -0.35 | 0.86 |

| Beta | 0.99 | 0.99 | 0.95 |

| Sharpe ratio | 0.59 | 0.45 | 0.47 |

As seen for short periods, DSP Equal Weight Fund has performed better. The UTI Nifty 50 Index has given stable long-term returns, and the SBI Blue Chip Fund has been almost in line with UTI. DSP Equal Weight Fund and UTI Nifty 50 Index perform superior to SBI Blue Chip Fund.

Read More:

I want to stop my SIP…but what will happen to my fund?

When a more prominent index component performs well. We recommend UTI Nifty 50 Index Fund. If larger constituents underperform, the DSP Nifty 50 Equal Weight Index outperforms the other two funds. In conclusion, index funds perform better than large-cap funds.