Home > Blog > Blog Detail

If you require help to build diversified portfolio. You are at the right place. You may hear this saying “Don’t put all your eggs in one basket”. The same is true for diversified portfolio. Many investors today are struggling to diversify their portfolios, but don’t worry; reading this blog will teach you how to do so.

What is diversified portfolio?

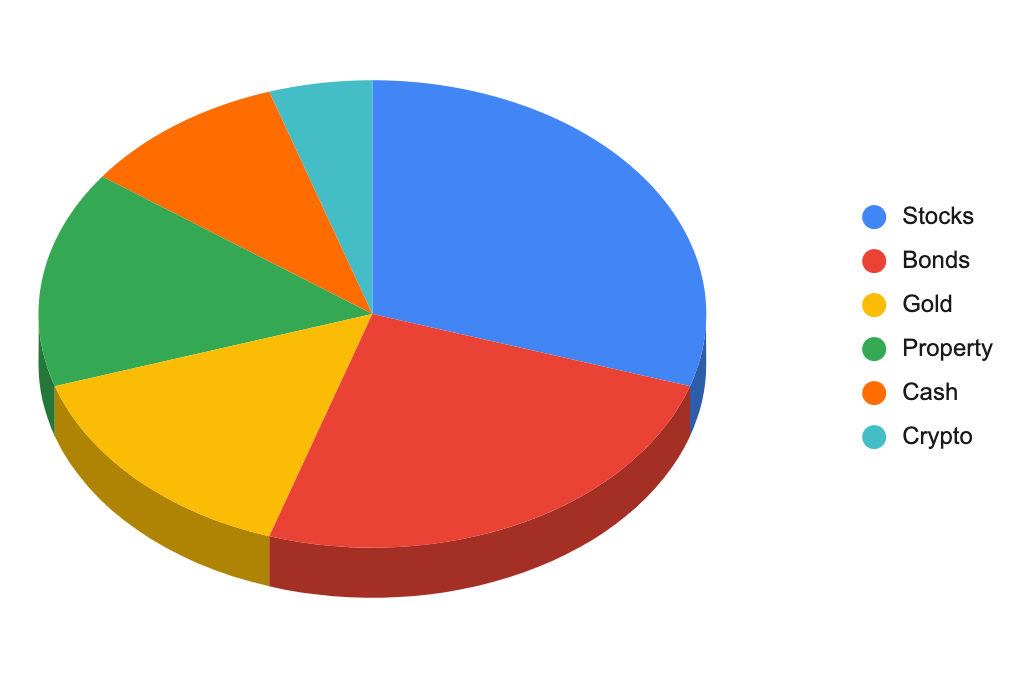

Diversification is a risk management method in which you can add a variety of investment items to your portfolio to assist you balance investment risk. In a nutshell, it is a risk-reduction approach.

Read More: Thumb Rules Of Investment: Every investor should know

Gen Z, people who born between 1996 to 2010. It would be best to prioritize continuous budget expansion for future developments in this digital era. So, Gen Z, are you ready for your future budget? If not, then this blog is for you! Today may, all people of your generation are looking for ways to be financially stable, and we find that door for you that is an early investment with a diversified portfolio; your portfolio must consist of little investment through SIP. SIP that is Systematic Investment Plan, where you can start investment with small amount and invest the fix amount. In future, you will get benefit from compounding interest strategy.

If you start investing in mutual funds, then go with Large-cap mutual fund. It is well known for performance because they invest in stocks of large companies, while mid-cap and small-cap also have room for good performance compared to the large-cap, but the risk is more compared to a large-cap mutual fund. So, we recommend you select the products which match your risk tolerance.

How will Millennial diversify their portfolio?

The millennial generation which is born between 1981 to 1996. this generation is willing to take risks and understands the concept of “risk” very well. This group is more mature than Gen Z and has greater responsibilities. Millennials also have more understanding of investing and navigating market fluctuations. But still, many need help to make a diversified portfolio, so your portfolio must consist more of equity.

If you have been investing for a long time or are a newbie who wants to begin an investment journey but wants to invest in a particular stock whose market price is high from your investment, you can still invest by doing stock SIP. Here you can invest a specific amount every month for that share. Also, you can make your portfolio diversified by doing stock SIP. So it recommends increasing the equity proportion by doing stock sip to achieve your financial goal faster.

Investing will vary based on your age and retirement goals. If we talk about generation X, who born between 1665 to 1981. If you are closer to retirement, your investment strategy may differ from that of Gen Z and Millennials. However, it’s never too late to start investing. In fact, it’s a necessary time to begin so that you can have a secure retirement. The first step towards retirement planning is to analyze your financial status, set your retirement goals, and determine your expenses.

Now you cannot achieve your dreams by only doing savings. You have to put your money in the market. You can go with NPS (National Pension Scheme) voluntarily, defined as a retirement saving scheme. This is based on a unique Permanent Retirement Account Number. The government of India made this body to boost savings. This scheme was made from the security point of view, and they offered benefits to NPS account holders.

Read More: The Innovative Way to Invest in the Stock Market

Still, if you want to know more about any scheme or wish to take your first step towards investment and need clarification with selecting the scheme, don’t worry. Take advice from a financial advisor; they will plan your investment which matches your set future and retirement goal and help you to achieve your financial goals faster.