Home > Blog > Blog Detail

The SWP is a wise investment strategy provided by mutual funds for investors who want to generate consistent income from their investments. The SIP (Systematic Investment Plan) is the opposite in that it does not permit withdrawals, but the SWP plan does allow withdrawal of fixed or variable amounts at regular intervals. Using this method, you can plan a mutual fund investment strategy that will produce a stream of regular income in your retirement age.

SWP is a benefit provided by mutual funds to their investors who desire to make a consistent income. Investors who invest in mutual funds in this way can redeem a specified or variable amount on a monthly, quarterly, or annually, depending on whether they are planning for steady income or saving for retirement.

Read More: Investment Vs Insurance: What should be your first choice?

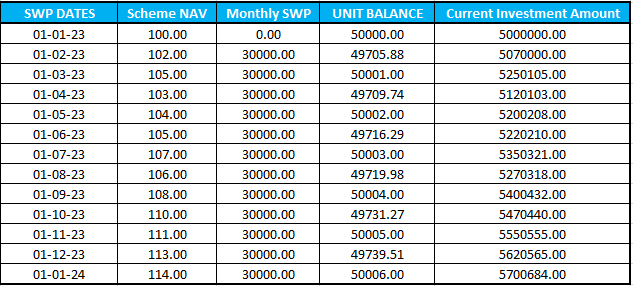

Let’s look at an example to better understand how a SWP works.

If you want to withdraw a set amount from your ₹50 lakh corpus each month, you can set up an SWP to do so by withdrawing ₹30,000 each month.

While you set up an SWP, you instruct the fund house how much money you want to withdraw from your fund and transfer to your bank account on a monthly, quarterly, or annual basis.

Investors are not required to pay any TDS on the funds received through an SWP. This is for people who fall into a high tax bracket.

Systematic Withdrawal Plan permits you to withdraw a particular amount of money on a monthly, quarterly, or yearly basis, providing you with a consistent source of income to cover your expenses.

This is a great alternative for people who are searching for post-retirement regular income, but for that, they must invest an amount first through SIP or a lump sum, and then they can create a pension for the retirement phase.

This strategy is a fantastic way to live after retirement because it enables you to receive consistent income from your corpus. You can use this money for a variety of things, including retirement, education, marriage and other things. Moreover, SWP gives you tax benefits and the ability to use your money in an emergency. So, here we have discussed systematic withdrawal plan, but if you want to plan your retirement with expert guidance you can contact a financial advisor.