Home > Blog > Blog Detail

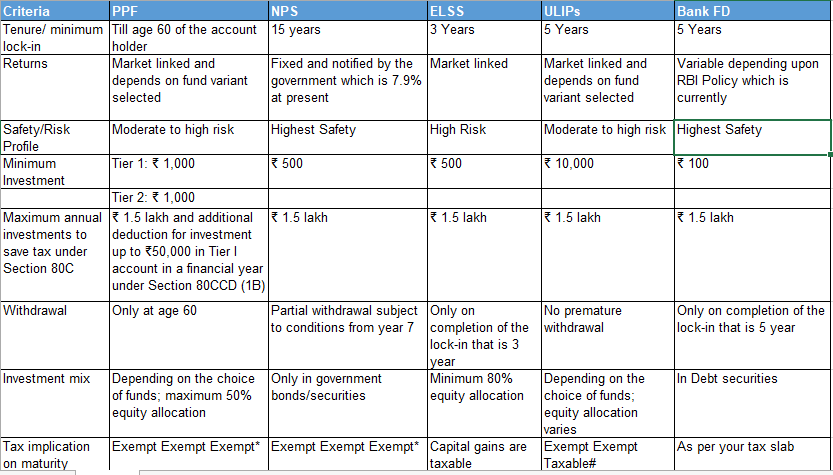

Attention to all who are planning to save tax with ELSS. The Super Tax Saver season is coming to an end. As a result, this is the last opportunity to invest in ELSS. Under Section 80 C of the Income-tax Act, standard tax-saving instruments such as Fixed Deposits, ULIPs, PPFs, and NPS are available. ELSS, on the other hand, is one of the most sought-after tax-related assets.

Read More: Are you planning to save tax? Invest in equity product ELSS

ELSS, or Equity-Linked Saving Scheme, is a tax-advantaged mutual fund scheme mainly investing in equities. It is an open-ended diversified equity plan with the dual benefit of tax savings under Section 80C and wealth-building potential.

Why ELSS? Check out the table below and the entire blog to find answers.

*EEE: This means your money is exempt from taxes at the time of investment, any return(dividend) and withdrawal.

#EET: This means that your money is exempt from tax at the time of investment and for any returns (dividend) generated but taxable at the time of withdrawal.

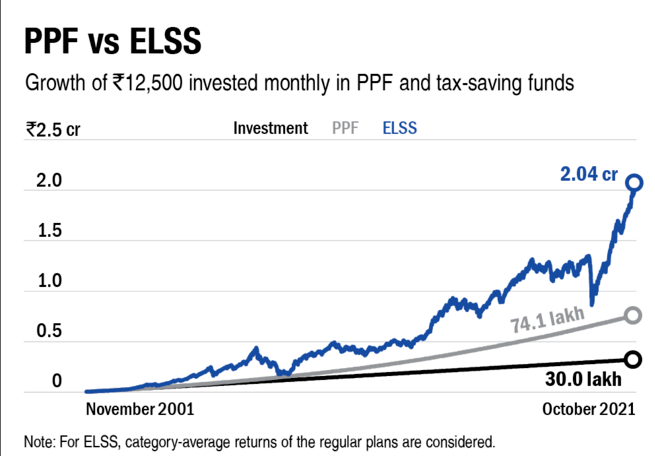

Let us examine the returns of the most popular tax-saving options, PPF and ELSS. The returns generated by ELSS are superior to those generated by PPF.

If you choose ELSS, you can spend Rs.12,500 per month, which equals to Rs.1,50,000 per year. As a result, the investor’s entire expenditure is tax deductible.

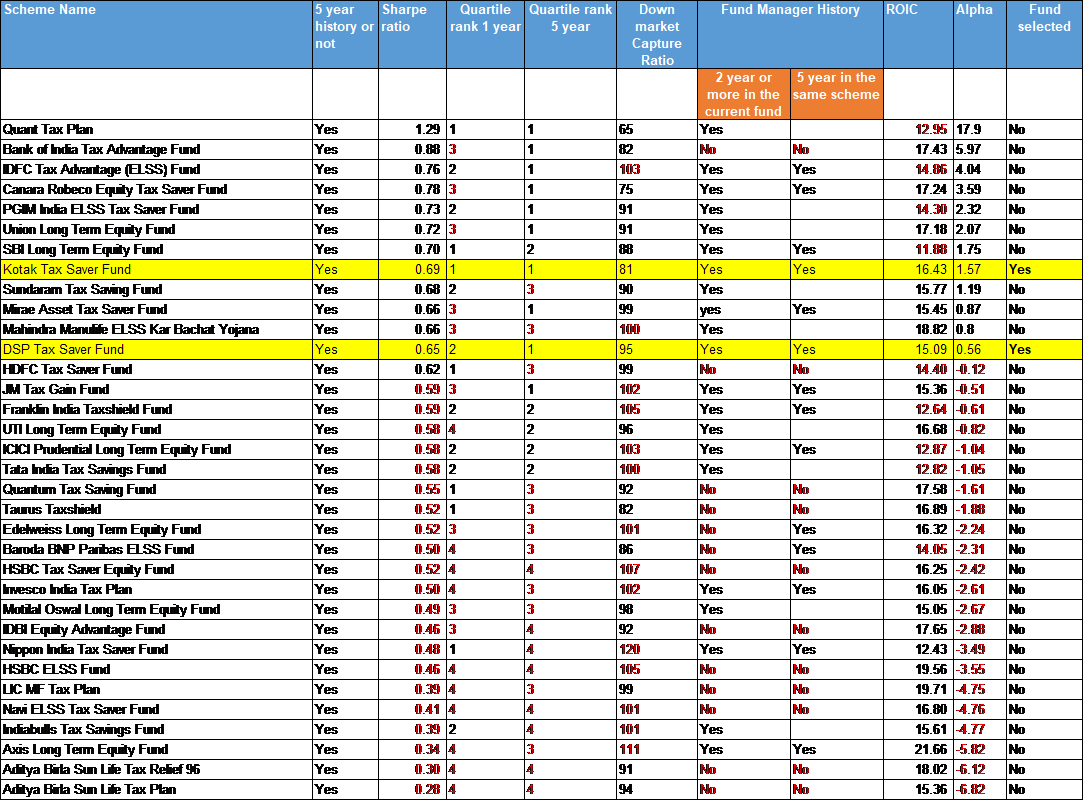

Now that there are 41 plans, how should one proceed? Although there is no definition of the best scheme. So, here we came up with the seven parameters listed below to shortlist funds from 41 schemes.

Read More: Make your kid’s future safe and secure: Mutual Fund is the BEST option

The fund’s history is needed to study. In addition to this, how the fund performed in bad times and how it performed in good quarters.

Threshold: At least 5 years of experience

The Sharpe ratio evaluates the relationship between an investment’s return and risk. It is a mathematical statement of the concept that long-term excess returns may indicate greater volatility and risk rather than superior investing ability.

Threshold: Greater than 0.6

A mutual fund’s quartile rank is a measure of how well it has done in comparison to all other funds in its category.

Threshold: We use two quartile ranks of one year and five years to comprehend the scheme’s long-term and short-term performance. Only those funds which are in 1st two quartiles are selected.

This ratio is used to evaluate an investment manager’s success compared to an index when that index falls.

Threshold: This value should be less than 100.

‘Experience is simply the name we give our mistakes’, so we included this fact in our research to ensure that the fund manager handling your funds is not inexperienced and has extensive experience in the field.

Threshold: 2 years or more experience in the current fund that the manager manages; if he is a new manager, with less than 2 years of experience in the current fund, whether he has at least 5 years of experience handling the same scheme type.

This stands for return on invested capital and is one of the most commonly used signs when discussing investments. It demonstrates the value produced by investments.

Threshold: greater than 15%

Alpha measures the extra return the scheme produces over its benchmark for a given level of risk.

Threshold: Positive alpha will show that the scheme has generated higher returns than its benchmark.

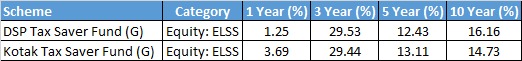

We filtered out the two schemes that meet all seven criteria after implementing all of the criteria.

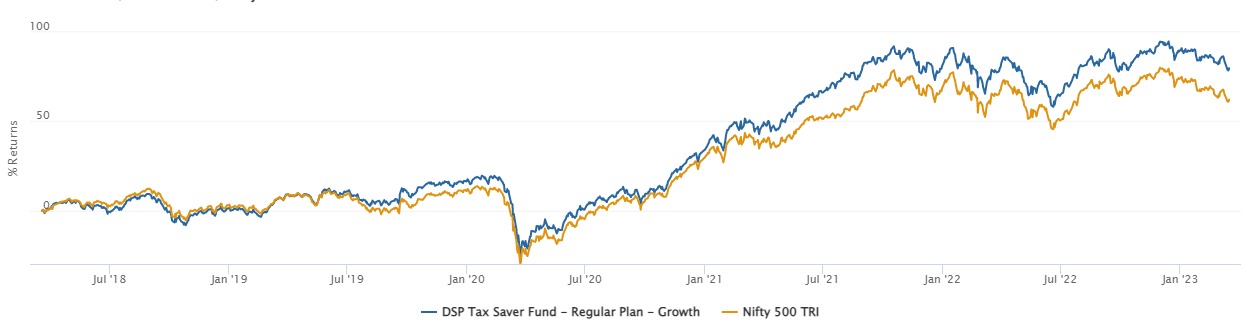

Let us look at the returns generated by these two funds over the years compared to their benchmark.

Read More: ELSS VS PPF: How to Save Tax In A Better Way!

Bottom Lines

If you are young, earn a respectable or high income, want to achieve your financial goals, counter inflation, have an investment time horizon of 3 years or more, are willing to take a calculated risk, and want to save tax while investing, equity-linked savings schemes (ELSS) are a worthwhile investment avenue.

So, it’s time to say goodbye to your tax worries. Jump the tax & land with High Returns. Invest in ELSS and receive a tax break under Section 80C.