Home > Blog > Blog Detail

Term insurance is a popular option among insurance purchasers nowadays. It is a straightforward plan that provides financial protection for a set period. Although a basic term insurance plan can be highly beneficial for most people, a term insurance with a return of premium plan can provide additional benefits.

Term insurance with a return of premium is a new variant of term insurance. However, you will find out what it is and why it is more beneficial in this blog.

So let’s begin!

Term life insurance is the most basic type of life insurance. It is also one of the least expensive types of life insurance. Term insurance does not include an investment component and guarantees a predetermined payout upon the insured’s death. Term insurance policies, in general, do not provide any survival benefits. The premiums are among the lowest at the beginning of the policy but gradually increase with the insured’s age. The policyholder pays a higher premium, receives no returns, and the need for extensive coverage decreases. All of this makes a standard-term insurance policy far from ideal.

A standard term insurance policy may not be the best option, but several types of term policies are available. Policyholders who want a term insurance plan that includes a survival and a death benefit can choose a term insurance plan with a premium return. The most significant advantage of term insurance with a return of premium is that the policyholder receives all premiums paid during the policy tenure back at the time of maturity.

A regular term insurance policy pays the sum assured upon the insured’s death. In addition to the sum assured, no other payments are made. In the event of the insured’s death, the TROP pays the sum assured to the nominees. However, if the insured survives the policy term, they will receive a refund of all premiums paid during the policy term. For instance, suppose you buy a term insurance plan with a premium return with a sum assured of Rs. 50 lakhs, a tenure of 30 years, and an annual premium of Rs. 8,000. In the event of an unfortunate incident, the nominee will receive Rs. 50 lakh. Furthermore, the insurance company will pay Rs if the insured lives through the policy term. 2,40,000.

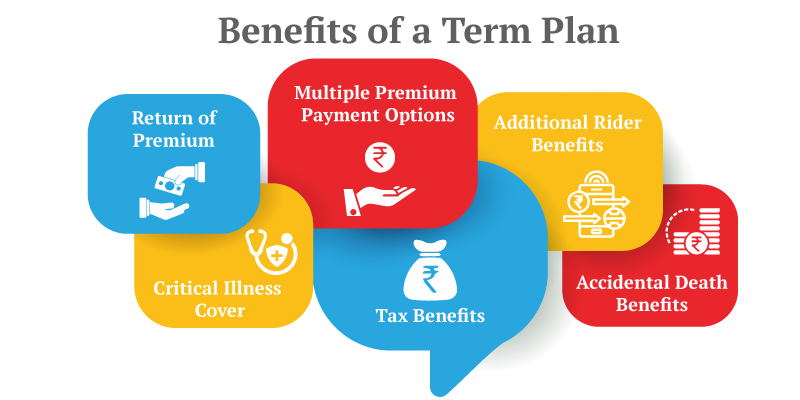

Term insurance with premium return provides all of the benefits of a standard term insurance plan and a survival benefit. It is an excellent choice for life insurance with guaranteed returns. Here are the advantages of purchasing a term insurance policy with a return of premium:

In this category, maturity benefits are not available with term insurance plans. However, if the policyholder outlives the policy term, they can get all of their premiums back with a return of premium term insurance plan.2. Death Benefit.

Riders can cover accidental death, disability, and critical illnesses. A term insurance plan with a return of premium and appropriate riders provides comprehensive coverage at a low cost.

This benefit you can use when you are doing tax planning. Purchasing term insurance with a return of premium allows the policyholder to reduce their tax liabilities. The policy premiums are tax-deductible up to Rs 1.5 lakh per year under Section 80C of the Income Tax Act of 1961. Section 10 (10D) of the tax laws exempts the payout from income tax.

Everyone has different goals regarding significant financial commitments, such as purchasing term insurance with a return of premium (TROP) plan. This is heavily influenced by personal factors such as age, source of income, lifestyle habits, and medical conditions. Analyzing your financial profile based on these key parameters can assist you in determining the best policy.

So, if you want to buy a term plan with a return of premium, you should weigh the benefits against these factors.

It is an excellent option for life insurance with guaranteed premium returns. Depending on your plan, you will receive a refund of all premiums at the end of the policy term.

So, select this new variant to protect your life and get the best coverage!