Home > Blog > Blog Detail

Why are individuals selecting SIP (Systematic Investment Plan) for investment to achieve their financial goals? What is SIP, and why its returns are so popular? Why should you choose SIP? This blog will answer all of your questions.

People select the stock market for rapid and high returns, but what if they lose money instead of making money? This occurs because not everyone has a thorough understanding of the stock market. SIP is thus the most incredible alternative for those who want to begin their investment adventure and systematically increase their invested money.

This is a summary of a systematic Investment Plan. It is the best option for investors and newcomers wishing to begin investing to reach their financial objectives. This is an excellent option if you are in college and want to start investing with your pocket money. If you are salaried and wish to invest monthly, you may also choose SIP. It is the best option for beginners when compared to others.

Investors can make investments in two ways:

Investors must invest a fixed amount of income every month. Lump sum investments are one-time bulk investment in a particular scheme.

If you are not good at paying bills on time, you may need to remember the instalment so we can auto-pay SIP. You can now make SIP payments from your bank account on the specified day.

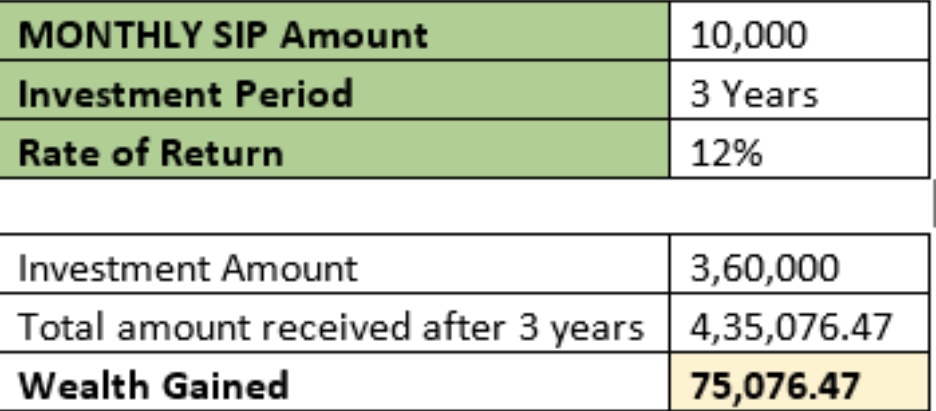

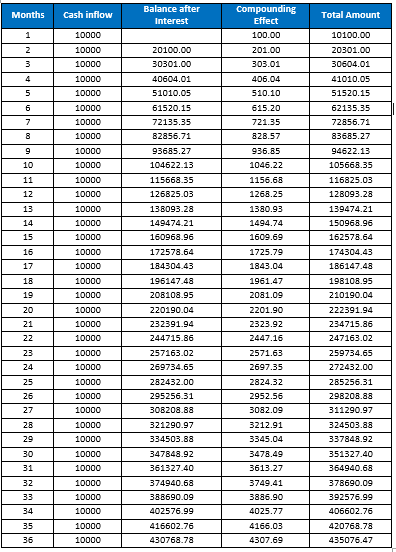

This option can provide higher returns. A calculator can also be used to forecast the returns. For example, if you earn Rs 40,000 per month and invest Rs 5,000 for ten years at 12% interest, your future earnings will be Rs 11.62 lacs.

It is a blessing if you get tax savings along with investing. So, here I present to you the concept of the ELSS scheme. Equity Linked Saving Scheme is a mutual fund where investors can invest and reduce taxable income. This scheme has a lock-in period of 3 years.

If you have long-term financial goals and have not yet stopped or cancelled your SIP, you will experience the incredible effect of compounding. For example,

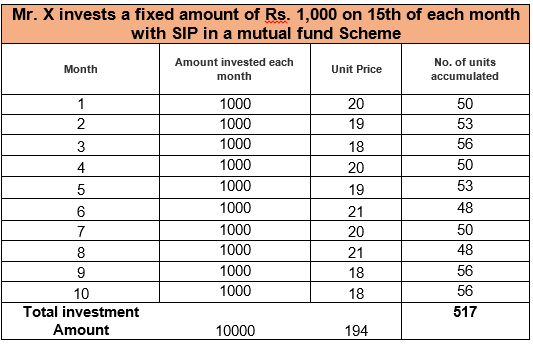

You can now buy more units when the market is down. Let us help you with the example,

There will be the features of Stop and Cancel SIP. If you cancel, then it will halt your instalment. The best thing is that there will be no penalty if you cancel your SIP at any moment.

SIPs are one of the most investor-friendly financial avenues. Their advantages range from modest and convenient investments to goal-based and disciplined investing. SIPs can help you accumulate significant wealth over time in mutual funds. So, it’s worth having an investment option in your financial portfolio.

So, when are you going to start your investment journey? Comment below for financial assistance.