Home > Blog > Blog Detail

People want shortcuts and easy solutions to manage their own money. Unfortunately, personal finance has been neglected; there is no formal education at school or college in our early years. So, in this blog, we’ve provided some investment rules to help you manage your money. It will be helpful for you before entering the market or start investing.

Every investor should first think about the emergency fund. We all know that life is uncertain. So, we must be ready with an untouched amount called an ‘Emergency fund.’ How much should I put aside for an emergency? The answer depends on one’s age and monthly spending, but a decent rule of thumb is to have enough money to last three to six months.

For example, if your monthly salary is Rs 30,000. Then your emergency fund should be 3*30,000, which is Rs 90,000. So, calculate your emergency fund with this thumb rule.

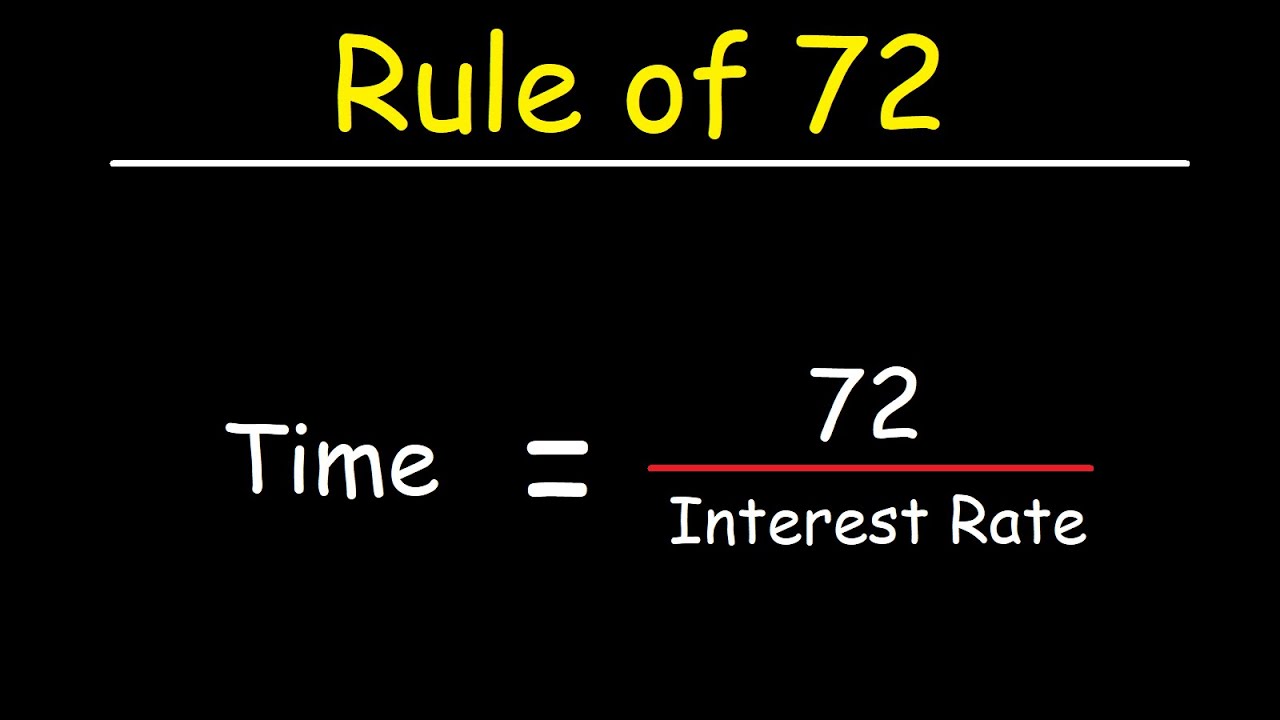

#2 Investment Rule of 72

Every investor wants to know how long it will take to double his investment; then you should consider this investment rule of thumb.

Divide 72 by the rate of return on investment you choose. Assume you have chosen to invest Rs 4,00,000 in a mutual fund that pays a 12% annual interest rate. Thus, It will then take six years to double your investment.

This rule shows how long it takes to triple your money. The mathematical formula closely resembles the rule of 72.

This rule works like the rule of 72. You have to divide the number 114 by the rate of return on investment you have picked. For example, if you have chosen to invest Rs 4,00,000, which provides a rate of interest of 12%, it will take 9.5 years to triple your investment.

#4 Investment rule 144

Finance experts have other criteria to determine how long it takes to double your money.

Suppose you want to invest Rs 4,00,000, which provides a rate of interest of 12%. It will take 12 years to triple your investment.

Read More: Why Are Index Funds a Better Choice over Large Cap Funds?

When you first start investing, you must allocate your assets. If it is not done correctly, it may impact your returns. If you’re unsure how to allocate your money based on your financial goals, here’s a simple rule.

You can divide your money in specific following ways:

If you need another rule to help you deploy your money to reach your investing goals, put 10% in long-term goals, 5% in a debt fund, and 3% in a savings account.

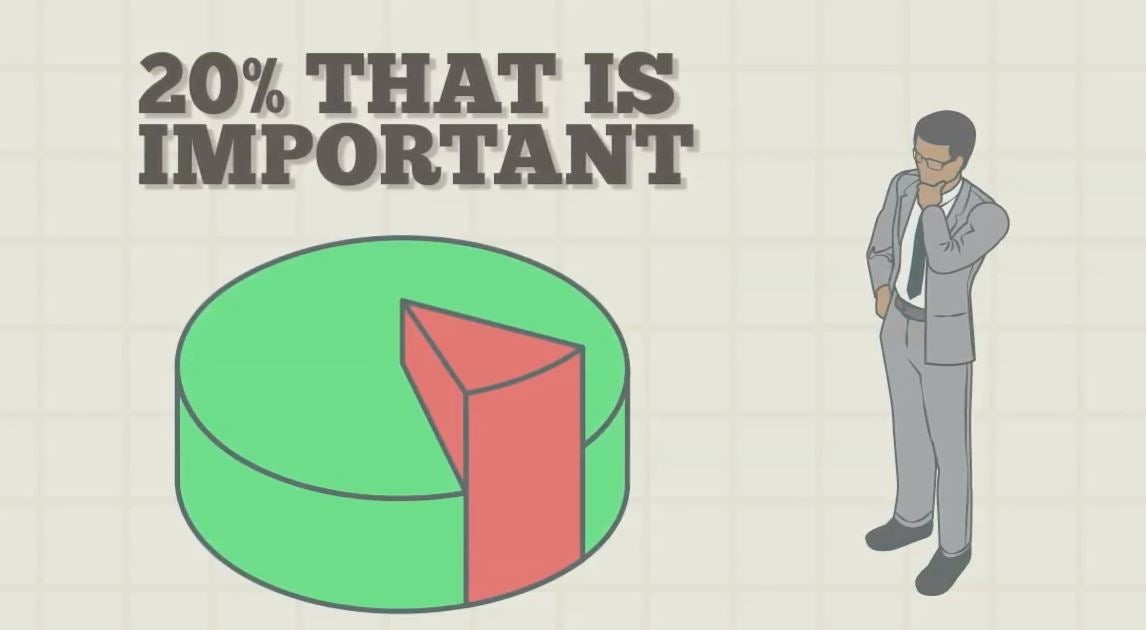

#7 Investment rule of 80, 20 or Pareto Principle

Many investors and businesses use this rule of thumb to attain their objectives. No formula is required for this guideline; it is all about risk and returns. Risk accounts for 20% of the equation, whereas outcome accounts for 80%. For example, 20% of your diversified portfolio accounts for 80% of your returns. So, invest according to this formula, obtaining 80% returns on your 20% portfolio.

This concept applies to everyone, not just investors; it is about balancing your everyday requirements, savings, and investments. Divide your monthly income by 50% for needs, 30% for wants, and 20% for investing.

Read More: The Innovative Way to Invest in the Stock Market

These thumb rules will help you to make your investment decisions sounder and more profitable. However, it is essential to consider other investment factors before making any investment decisions.