Home > Blog > Blog Detail

A retirement plan is one of every individual’s essential goals, but many individuals need to pay more attention to this goal, and the reason for this is that it necessitates adequate knowledge of financial planning and investing goals. A well-planned retirement is an essential component of financial planning. But first, let’s go through the fundamentals of this subject.

A retirement plan entails preparing for future unanticipated and anticipated events before retiring from the earning part of your life. Savings, asset planning, income sources, and risk management are all important considerations before retirement. These factors should be considered when planning your retirement age, but early planning is helpful. This will become clear as you continue reading this blog.

Read More: Make your kid’s future safe and secure: Mutual Fund is the BEST option

Retirement can be one of the happiest times of your life if you plan it carefully, considering the most significant aspects of financial objectives and planning. So, why is it critical to have excellent retirement investment planning? Delaying preparations can result in a daunting task later on, so starting early is important.

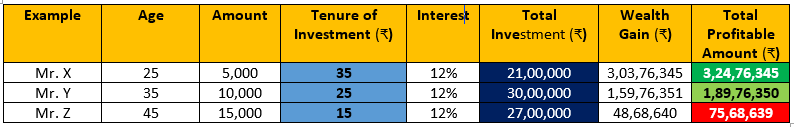

So, to answer this question, we developed a table of concept of comparison for early retirement planning. Have look!

This table clearly shows that early retirement investment has a significant impact. It is claimed that the sooner you start, the better. As a result, the earlier you begin investing, the more money you can make with less capital.

NPS is a government scheme that encourages savings; it was created for security concerns and offered incredible incentives. Another great advantage of NPS is the tax benefit; this means you can minimize your taxable income under Section 80c of the Income Tax Act of 1961. Let’s have a look at some more NPS benefits.

Investors using NPS can choose their investment portfolio and asset allocation based on their financial position and alter it as needed.

NPS provides a return of 9%-12%.

If you want to invest for the long term, mutual funds are the way to go. These schemes are unrestricted; selecting the appropriate scheme and goal is crucial for long-term success. SIP (Systematic Investment Plan) is currently one of the most popular plans. In this, you can invest a tiny sum on a monthly, weekly, or quarterly basis. SIP is an excellent approach to invest regularly over time; additionally, you can benefit from the power of compounding; and market risk is decreased with SIP. As a result, SIP is a terrific strategy to reach your retirement objectives.

Bonds are also an excellent investment option if you expect to retire and want to invest a large money. Bond investors must be aware of the dangers, especially in the event of a default. Bonds, on the other hand, are a great way to diversify your portfolio if you desire regular returns.

Bond’s returns are dependent on the bond in which you have invested as a corporation, government, or agency.

The government introduced this scheme for the unorganised sectors. This scheme is accessible in post offices and has a lock-in term of 15 years. You will receive guaranteed interest on the amount invested. You can save up to 1.5 lahks annually and deduct it under section 80C. This can be done with as little as Rs 500.

Read More: Diversified portfolio for Gen Z, Millennial, And Gen X

We have presented various investment options for retirement planning in this section. You can contact a financial advisor if you have any further questions or want an expert to help you choose an appropriate retirement plan. You can also tailor the above settings to your specific interests and goals.