Home > Blog > Blog Detail

If you’re interested in investing in the stock market, you may have heard of a new financial tool called Smallcase. Smallcase is a one-of-a-kind investment platform that allows clients to invest in a group of companies or ETFs based on a single subject or idea. In this blog, we’ll examine what Smallcase is, how it works, and why it’s such a unique investment method.

Smallcase is an investment platform that allows clients to invest in a group of companies or exchange-traded funds (ETFs) based on a single topic or idea. You may, for example, invest in a smallcase that includes stocks of firms focused on sustainable energy or in a smallcase that includes stocks of companies predicted to benefit from a growing trend in e-commerce. Smallcase provides investors with a selected list of companies or ETFs that correspond to the concept or notion of the smallcase. Only NSE stocks may be added to smallcases while creating, managing, or customizing them.

Read More: Why Index Are Funds a Better Choice over Large Cap Funds?

To begin investing with Smallcase, you must first open an account with a broker that supports Smallcase. Once you’ve created an account, you can browse through the Smallcase platform’s many smallcases. Each smallcase contains a list of equities or ETFs you can invest in.

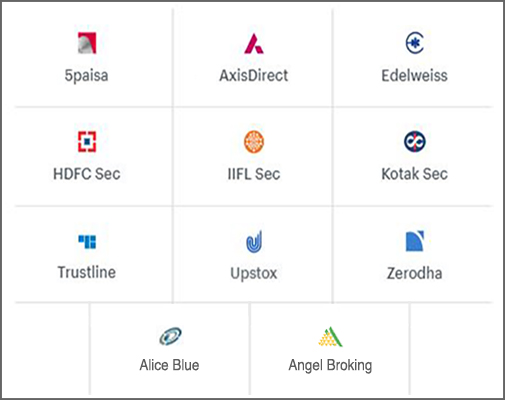

Once you’ve decided on a smallcase, you may invest in it by submitting an order to your broker. Your broker will subsequently purchase the stocks or ETFs in the smallcase on your behalf. In the smallcase, the amount invested is distributed proportionally among the equities or ETFs. This ensures that your money is spread across multiple firms and industries. To buy and sell the list, you would require specific brokers such as Zerodha, Upstox, Trustline, Nuvama Wealth, Motilal Oswal, IIFL Securities, ICICIdirect, FundzBazar, Dhan, AxisDirect, Angel One, and 5paisa.

Smallcase is unique for various reasons. For starters, it gives investors an easy and quick option to invest in stocks or ETFs aligned with a single theme or idea. For example, someone interested in renewable energy can choose Niveshaay Green Energy. This makes it simple for investors to establish a diverse portfolio without spending much time investigating individual companies.

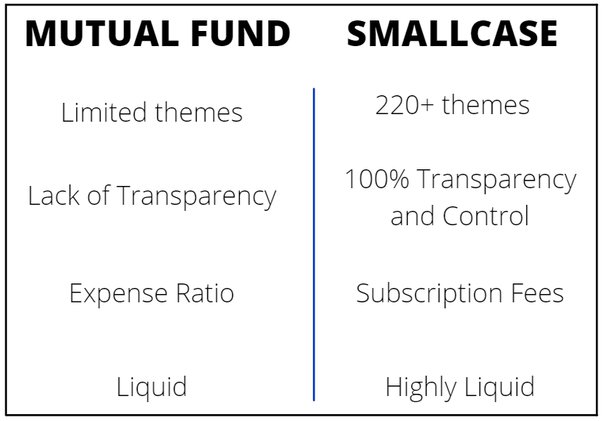

Second, Smallcase is intended to be transparent and easy to use. The site provides investors with specific information about each smallcase, such as the stocks or ETFs included in the smallcase, the small cases performance over time, and the fees associated with investing in the smallcase. Not only that, but the equities are also available in their demat accounts, allowing investors to see where their money is being invested.

Finally, Smallcase is cost-effective, unlike standard mutual funds or PMS, which frequently offer hefty fees or large ticket sizes. Each smallcase is charged a fixed price. This fee is often cheaper than the fees imposed by traditional mutual funds, and ticket sizes of as little as Rs 250 in smallcase make it accessible to retail investors.

Read More: Term Insurance with Return of Premium: Select a new variant to cover life

Let’s look at some of the benefits and drawbacks of smallcase.

Finally, Smallcase provides investors with a simple and cost-effective solution to build a diversified portfolio of stocks or ETFs based on a particular theme or idea. However, investors should be aware of the limited options, lack of personalization, market volatility, and reliance on a broker that comes with investing in Smallcase.

So, with Smallcase, get your investment portfolio DONE REGHT.